Introduction

Interest rate derivatives (IRDs) are the single largest asset class in traditional finance, with total outstanding interest amounting to over $400 trillion and trading volumes amounting to over $250 trillion in 2022, according to the Bank of International Settlements and ISDA association.

In crypto, a number of interest rate-bearing products rose to prominence in the 2018-2022 cycle, with billions of USD in payouts accrued yearly. However, the digital asset ecosystem still lacks an institutional-grade market that would allow investors to efficiently hedge against or make bets on fluctuations in such rates.

With the inevitable arrival of large-scale institutional capital and tokenization of securities, an on-chain market that would enable the management of blockchain-native and macro rate risks will become an even more essential part of the market infrastructure.

X Protocol: Opportunity

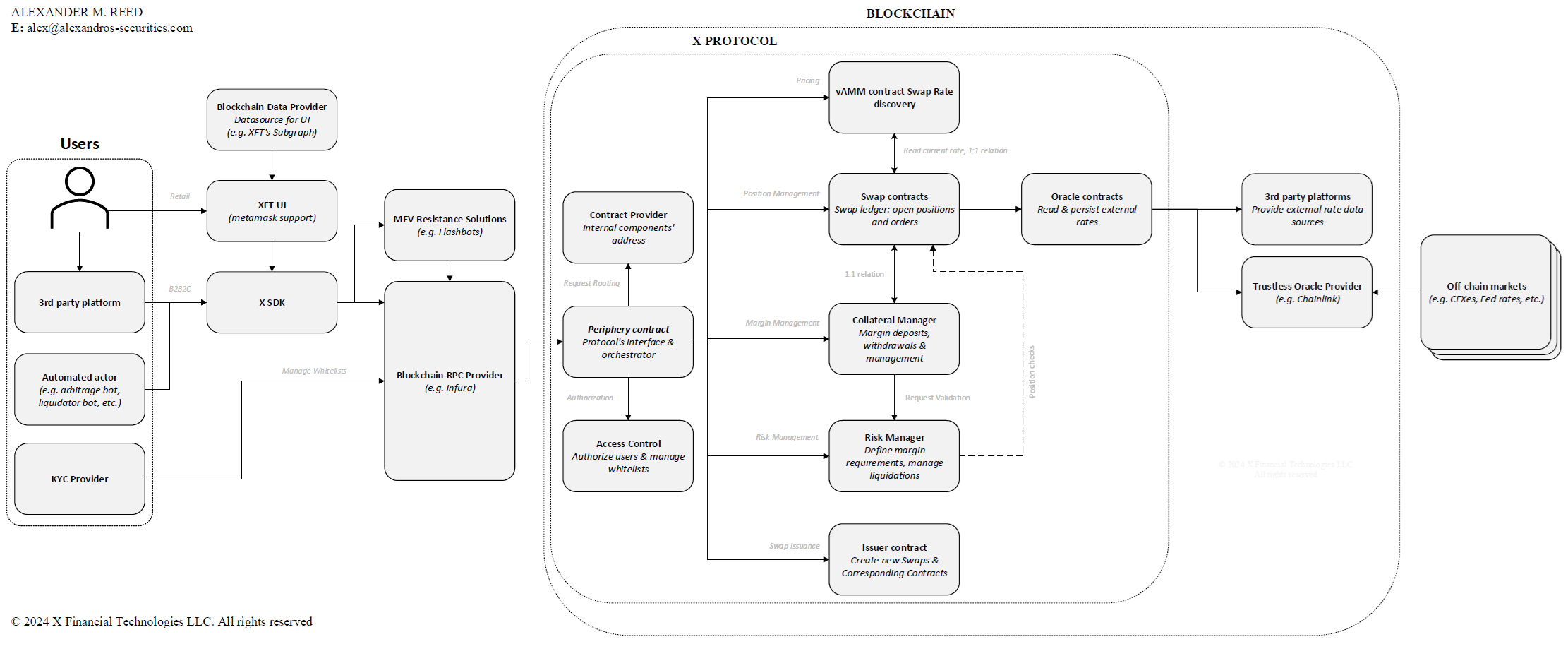

This paper covers the core principles and purpose of the X Protocol, a novel decentralized marketplace allowing professional traders to efficiently exchange rate risk via onchain swaps and futures in a secure, efficient, and compliant manner.

X Protocol's first family of products are fixed-to-floating interest rate swaps on a diverse set of index rates. In TradFi, this product comprises over 60% of the total outstanding interest in interest rate derivatives.

- Centralized and decentralized lending/borrowing market rates

- Staking reward rates

- Other floating rates that already exist or will emerge in the digital asset ecosystem

The above use cases present a lucrative, virtually untapped opportunity worth hundreds of billion USD in outstanding notional and 100s of millions in revenues today.

Future Use Case: Key Rate Risk & Tokenized Securities

Bulge bracket TradFi firms are pushing forward with the tokenization of traditional securities, including the $100 Tn+ bonds market. As allocations to digital assets and tokenized securities become an everyday practice for institutional investors, the influence of key rates on digital asset prices will become as prominent as in traditional markets.

By successfully addressing the established and emerging use cases, X Protocol aims to provide critical risk management tools to the ecosystem and help establish the onchain equivalents of market defining reference rates forming yield and swap curves.

Bringing interest rate trading onchain offers significant benefits for all market participants, including enhanced transparency and efficiency of risk management, efficient near real-time settlements, and reduced agency risks.

To Recap

X Protocol is bringing interest rate derivatives into the DeFi ecosystem, addressing existing market worth $300 Bn in outstanding interest. X Protocol is built for institutions and offers features uniquely catering to this client base, including innovative market pricing (vAMM), risk management, and compliance (permissioned market sections) solutions.

By becoming a pre-eminent digital asset rates market, X Protocol will be best positioned to offer onchain rates trading and management for the arrival of major institutions and securities tokenization.

Interest Rate Swaps in Traditional Finance

A swap is an agreement between two parties to exchange cash flows over a period of time. In the interest rate swap (IRS), such cash flows are calculated based on the fluctuations of underlying rates.

Contact

For more information, please email: alex@alexandros-securities.com