Our Solutions

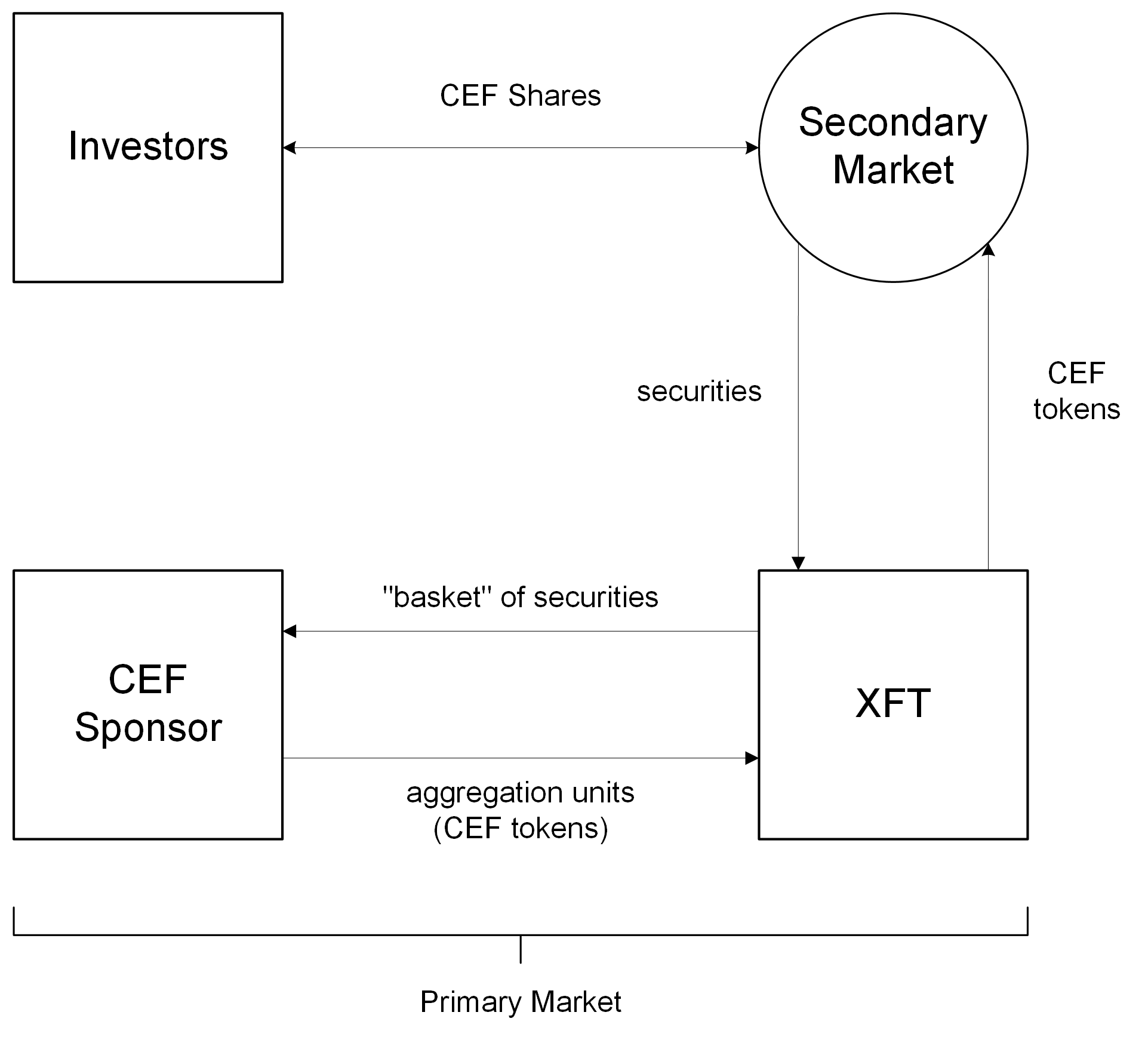

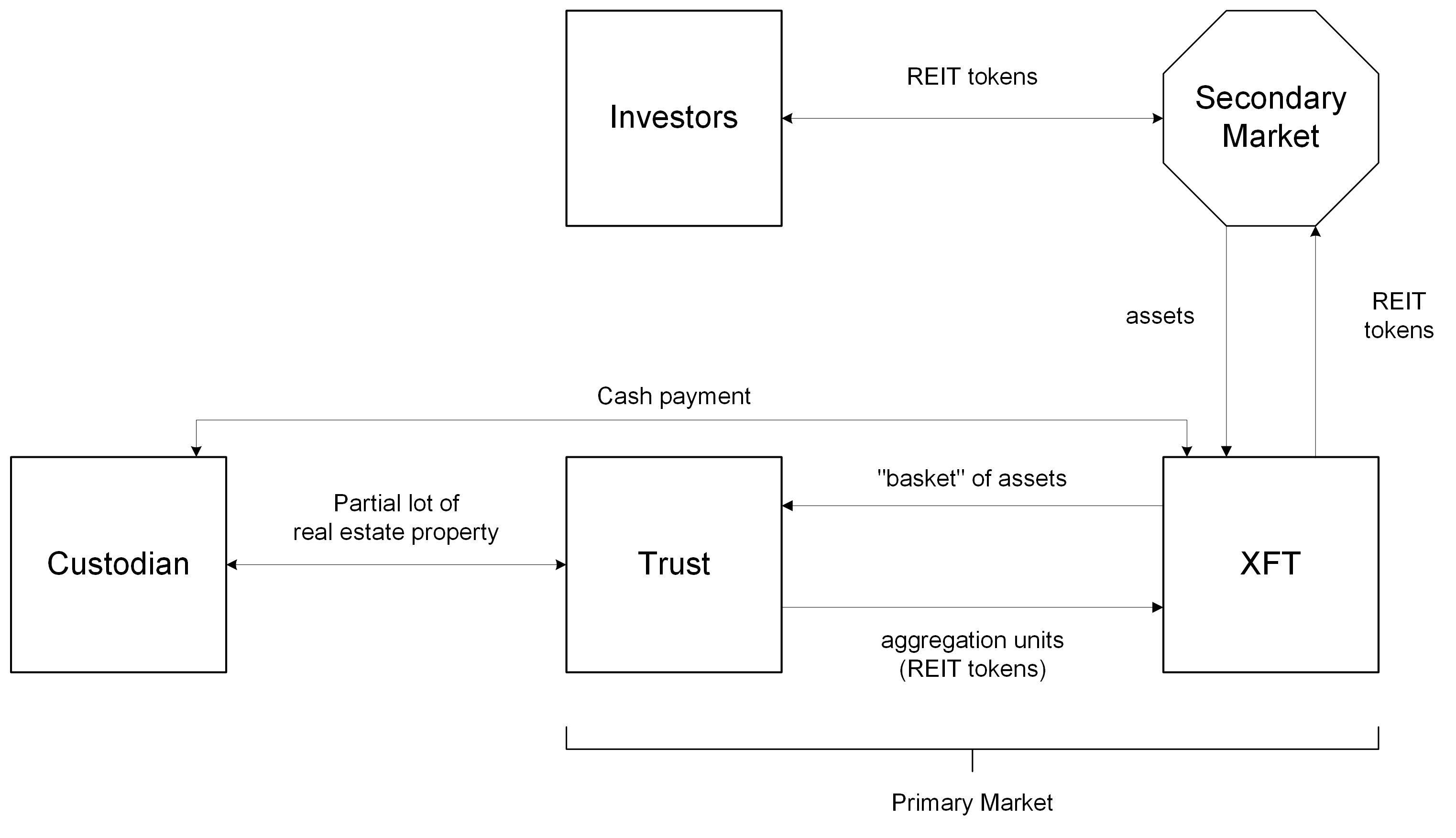

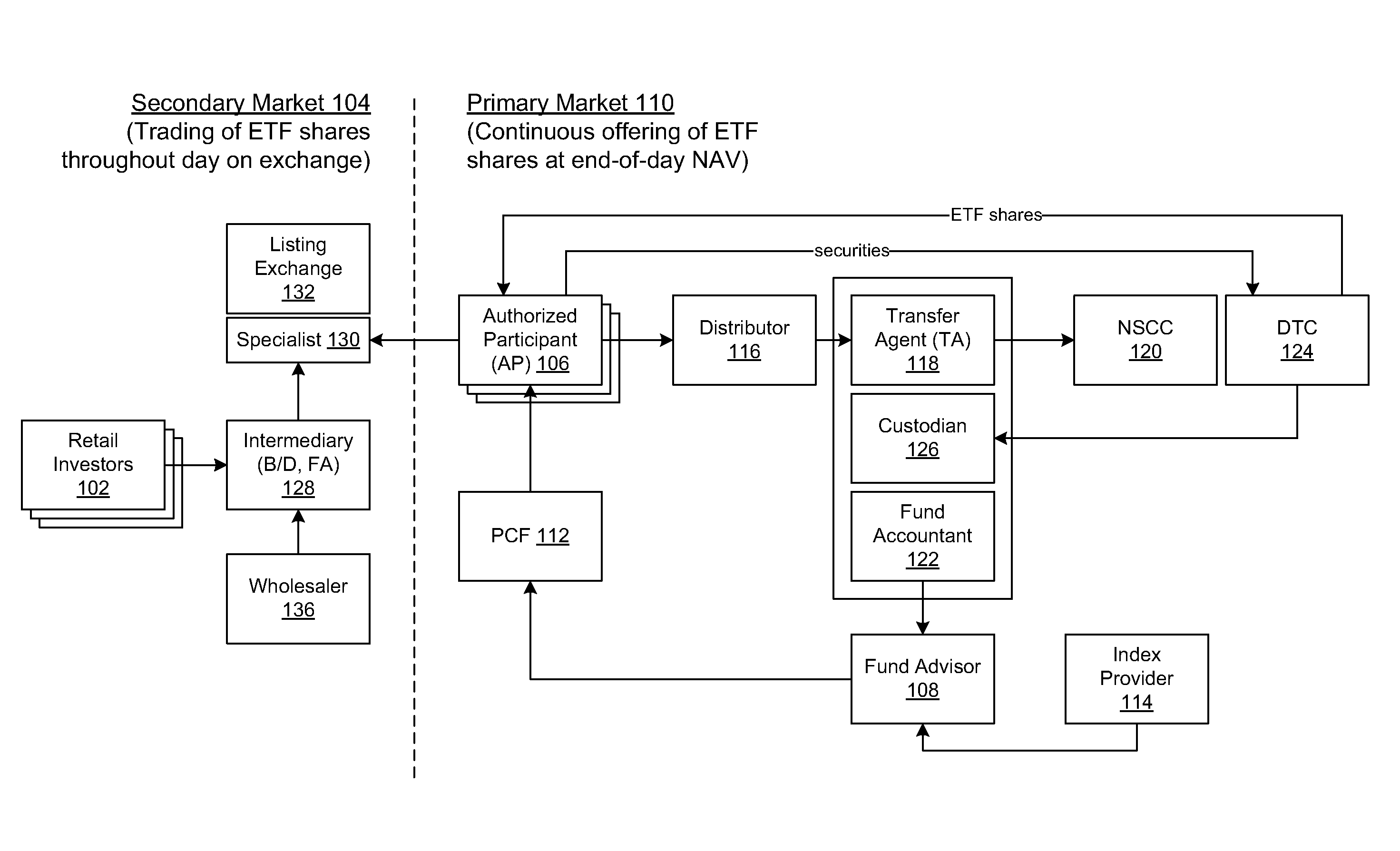

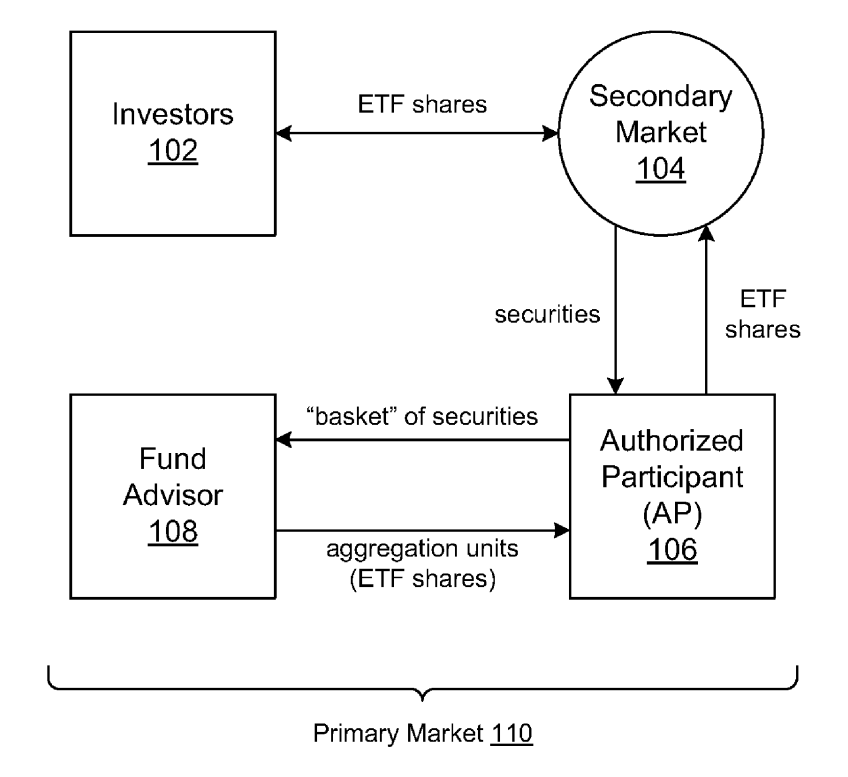

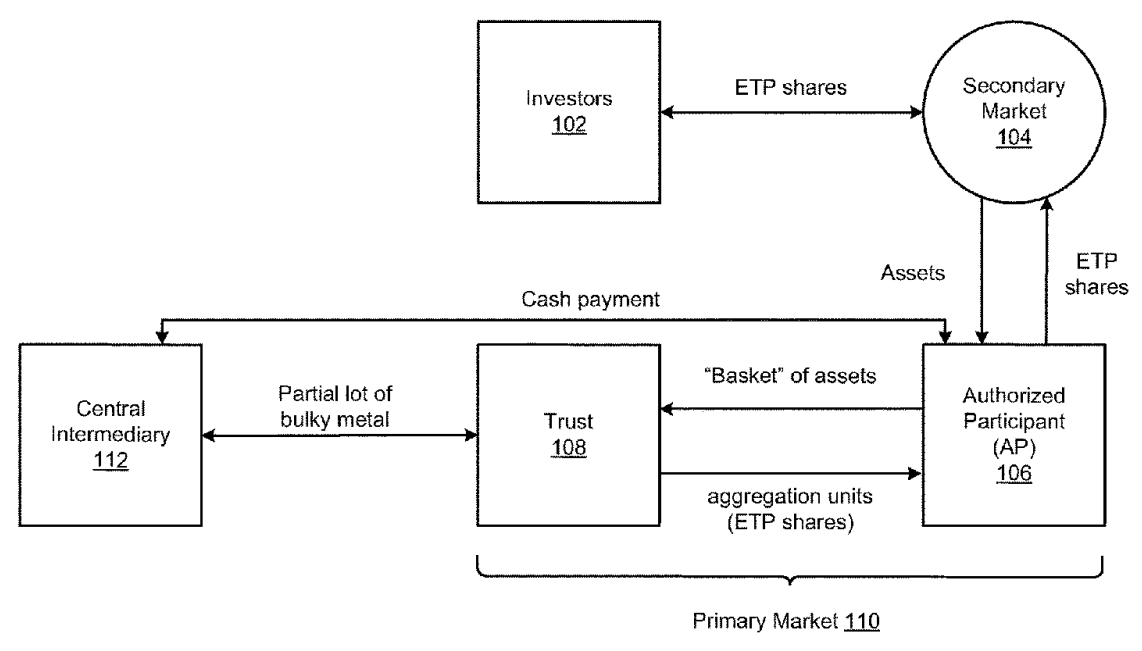

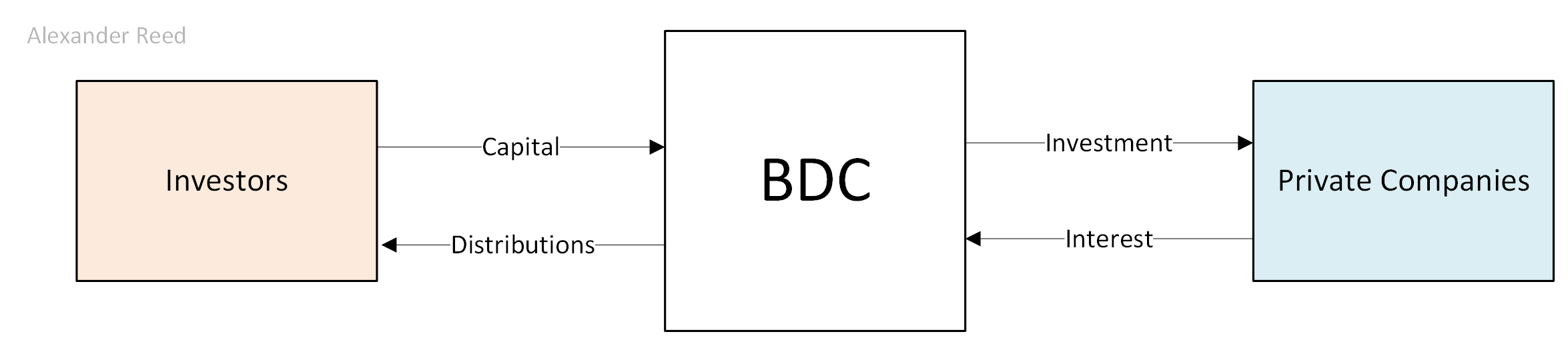

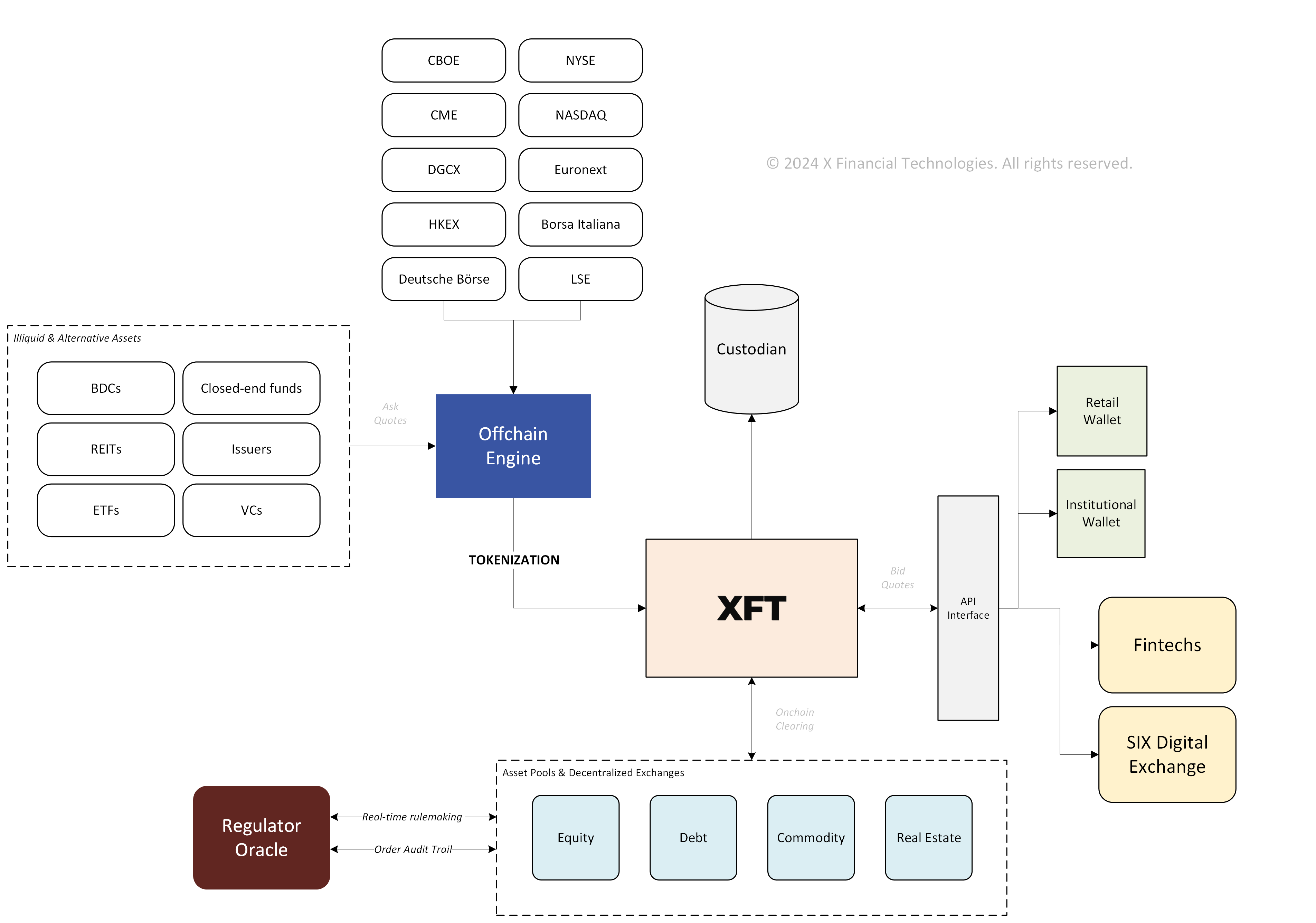

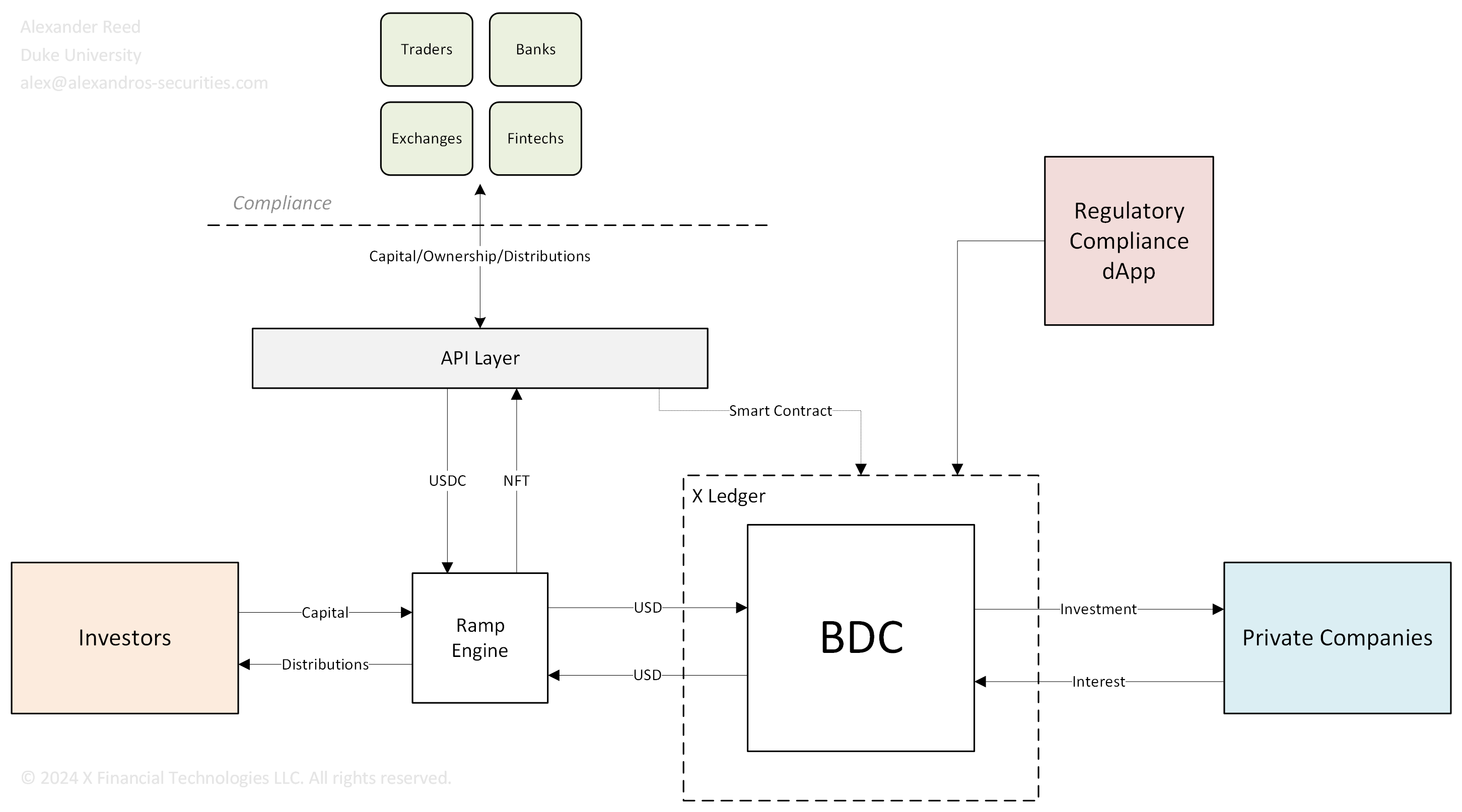

XFT is a market maker for illiquid alternative assets. We introduce a second layer of liquidity for closed-end funds, REITs, BDCs trading at significant premiums or discounts to NAV. Here are our core offerings:

- NAV Token

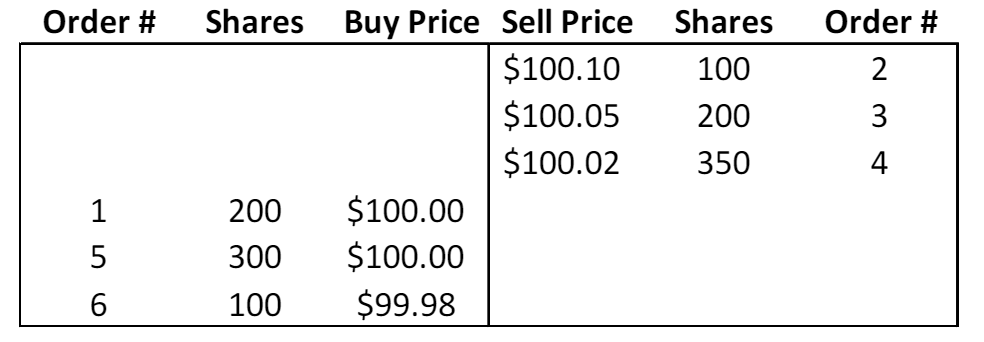

- Alternatives Orderbook

- RegTech

- Fund Launchpad

Idea Maze

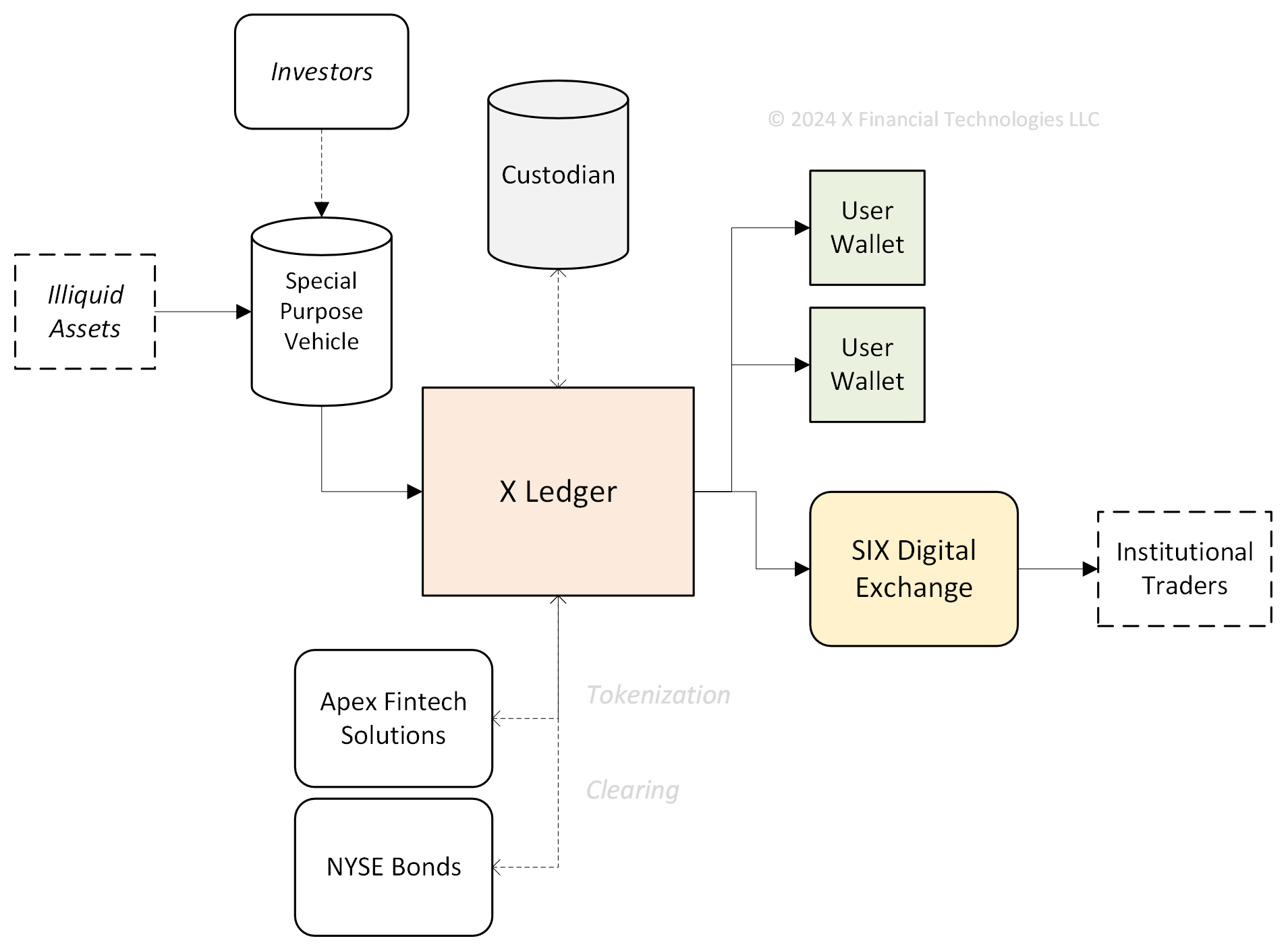

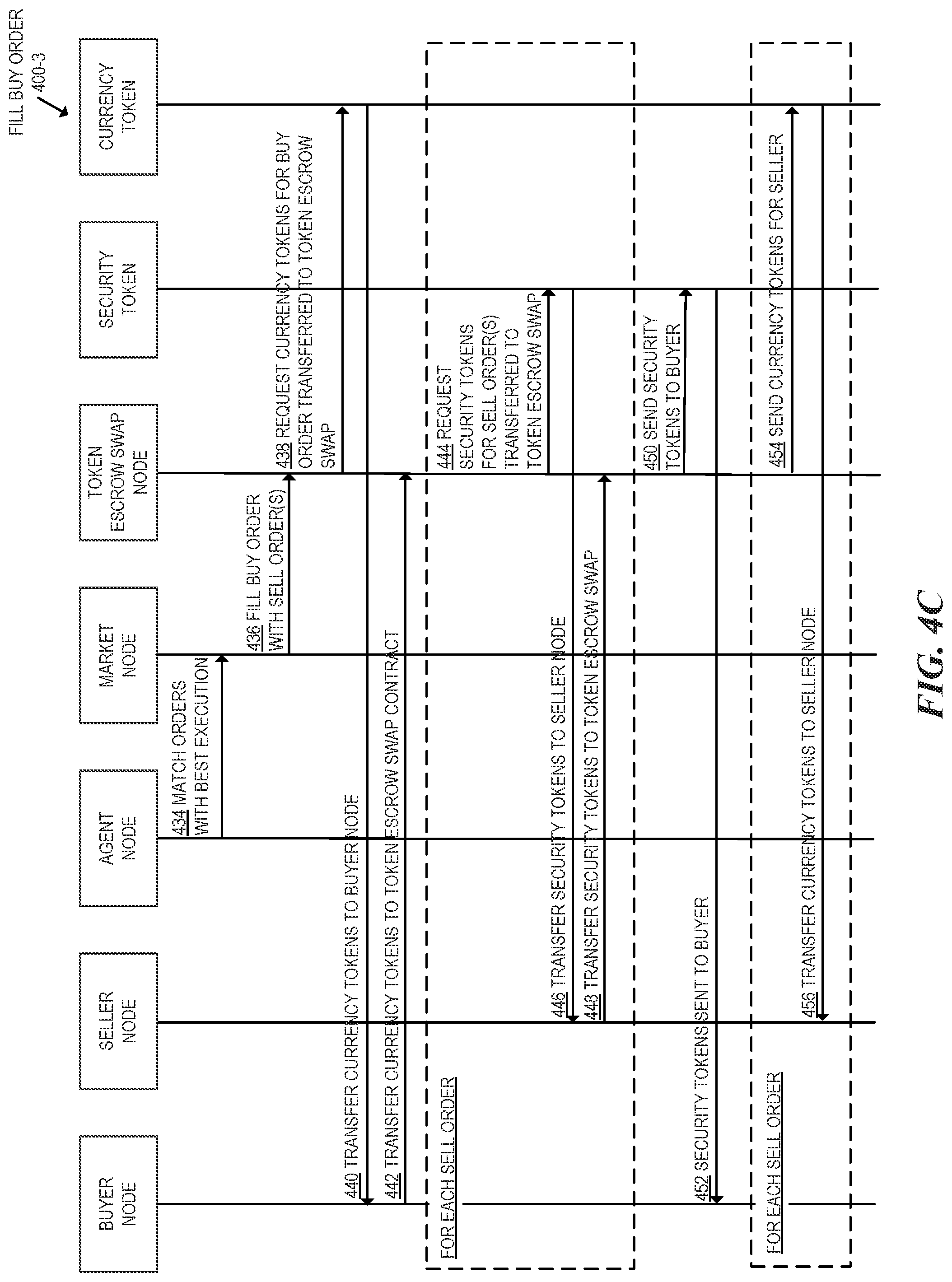

- X Ledger

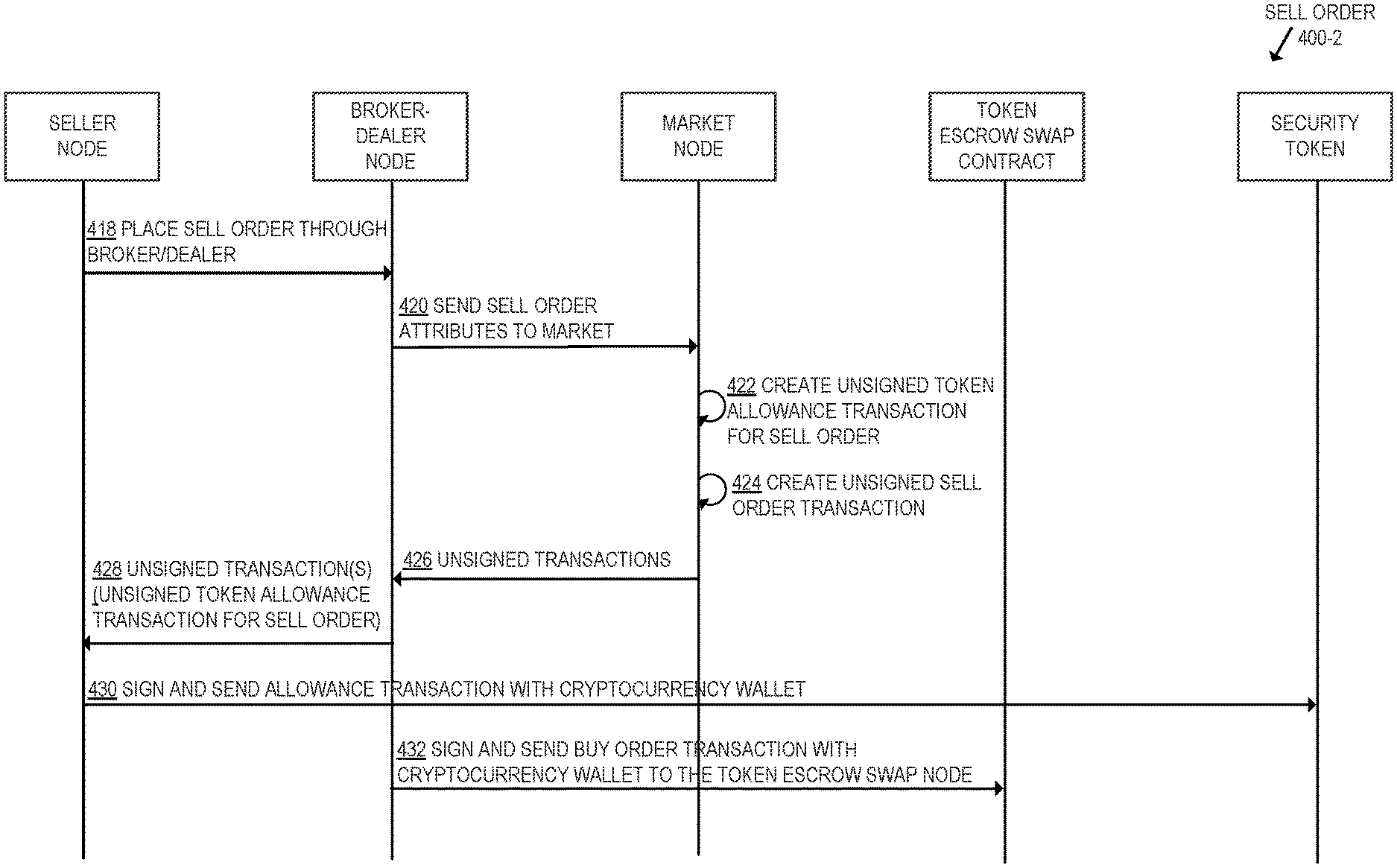

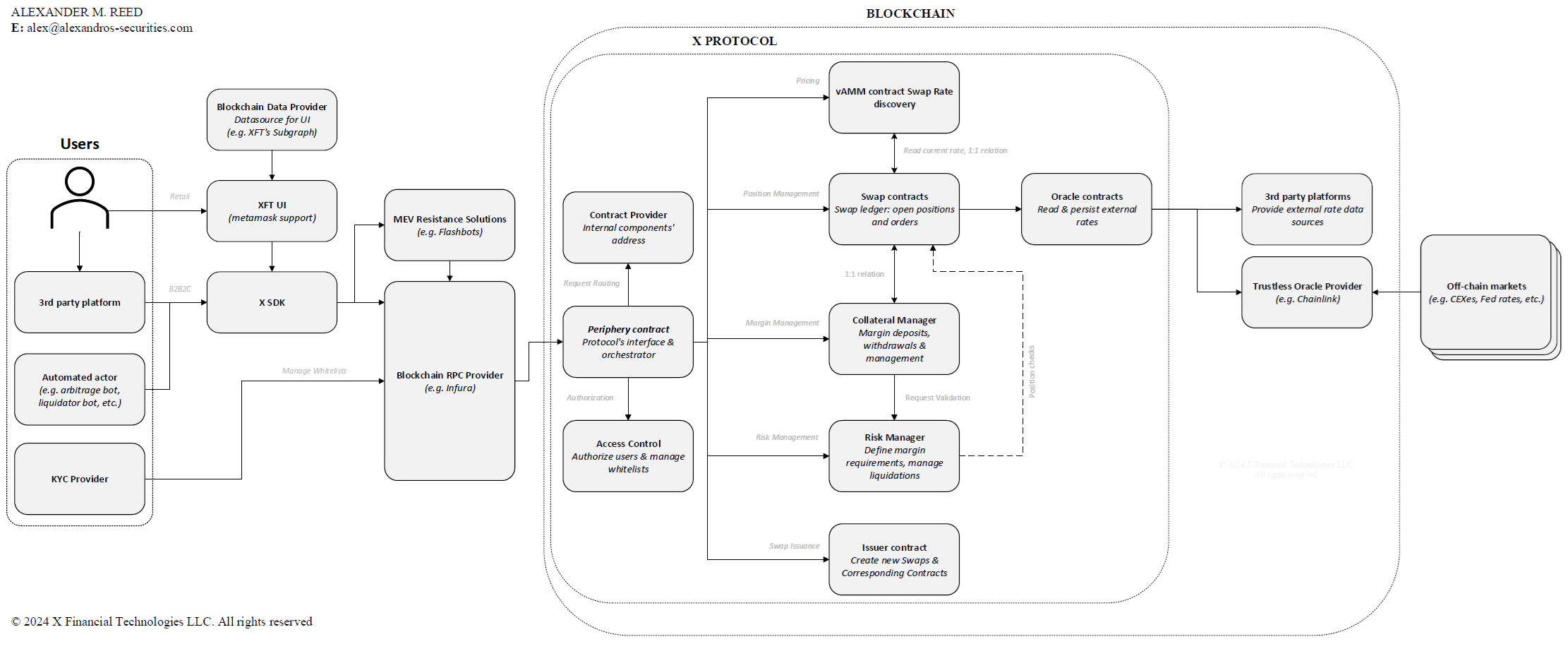

- X Protocol

- X Net

- API Interface

- xBank

- Market Making

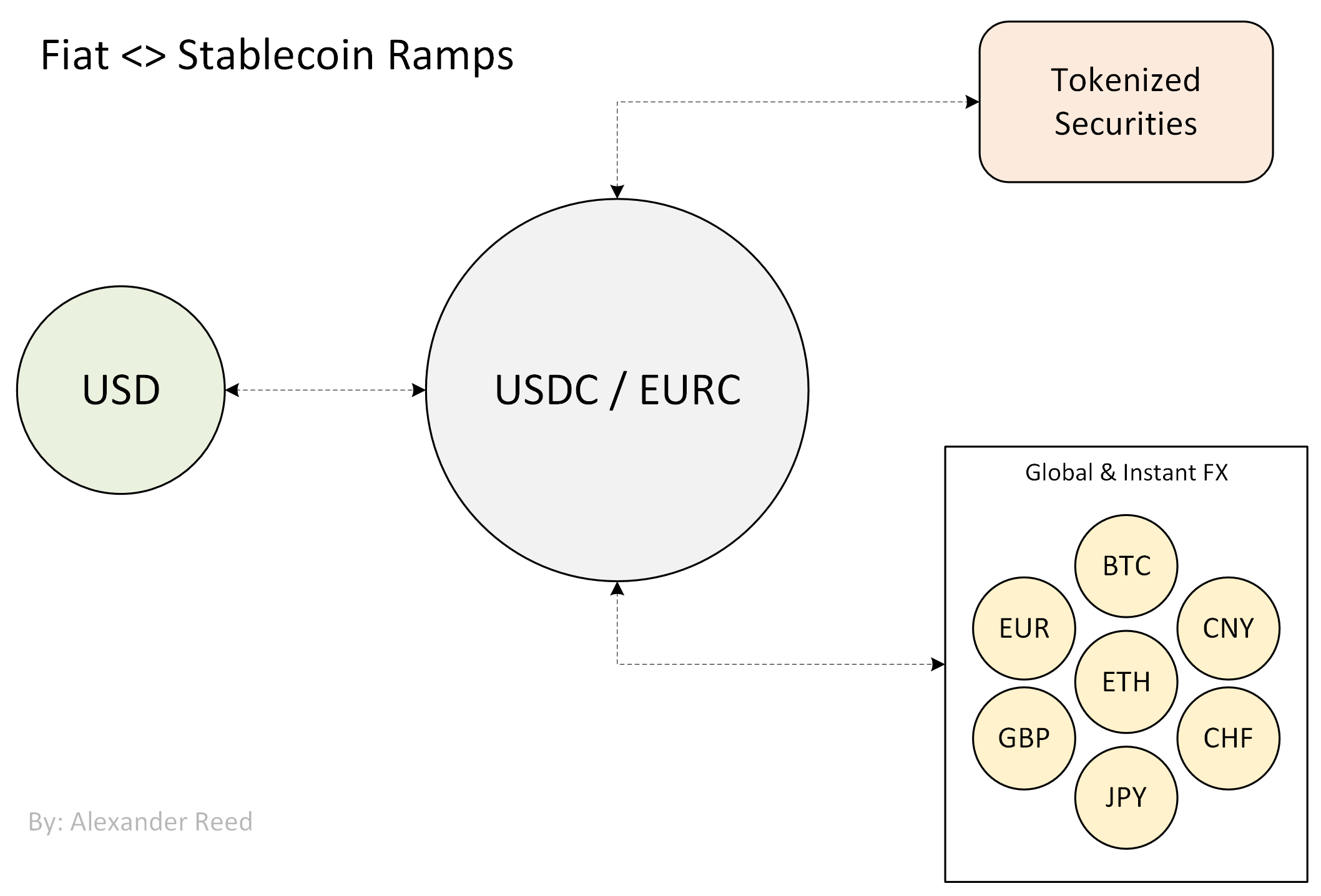

- Payments

- Lending

- xCard

- xPools

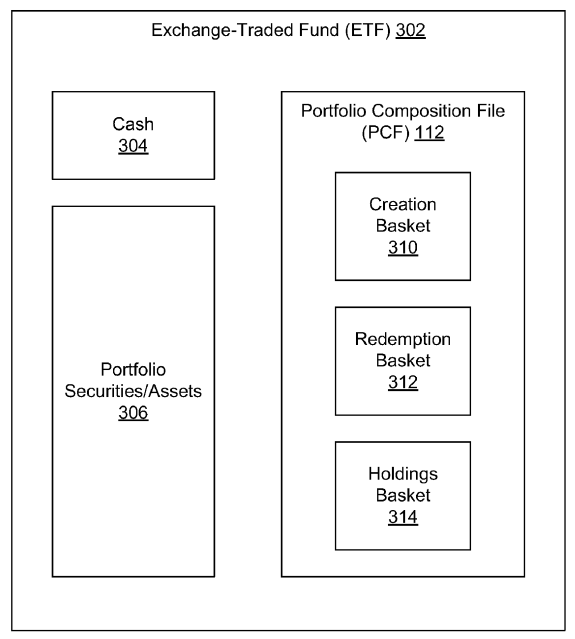

- Onchain Synthetic Indexing

- Alternatives Indexing

- Fund Token Launchpad

- Issuance Dashboard

- Prime Brokerage

- Onchain Fund Management

- Regulator Dashboard

- Real-time rulemaking

- Compliance DApp + Oracle

- Compliance-as-a-service

- Custody-as-a-service

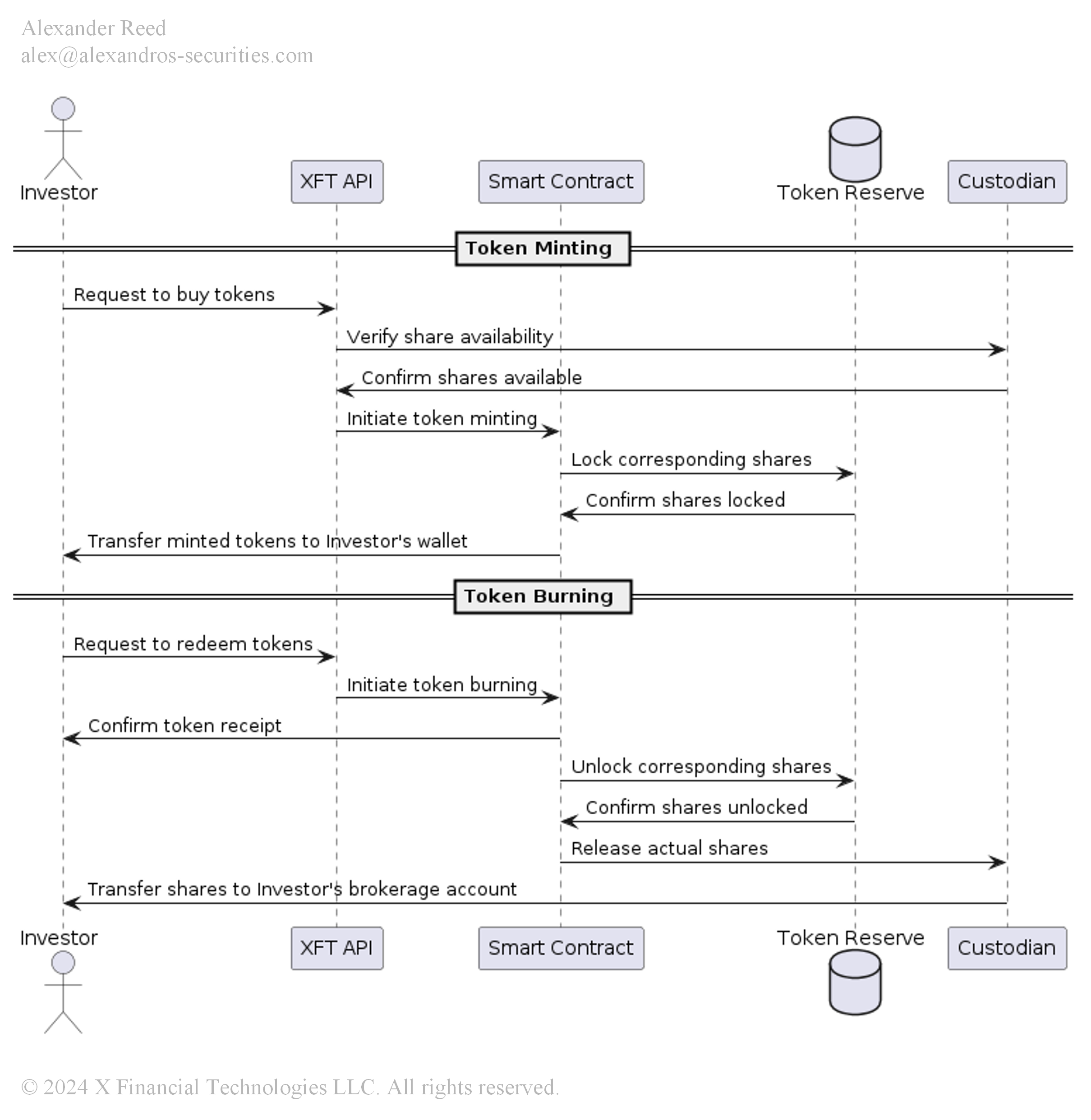

- Tokenization-as-a-service

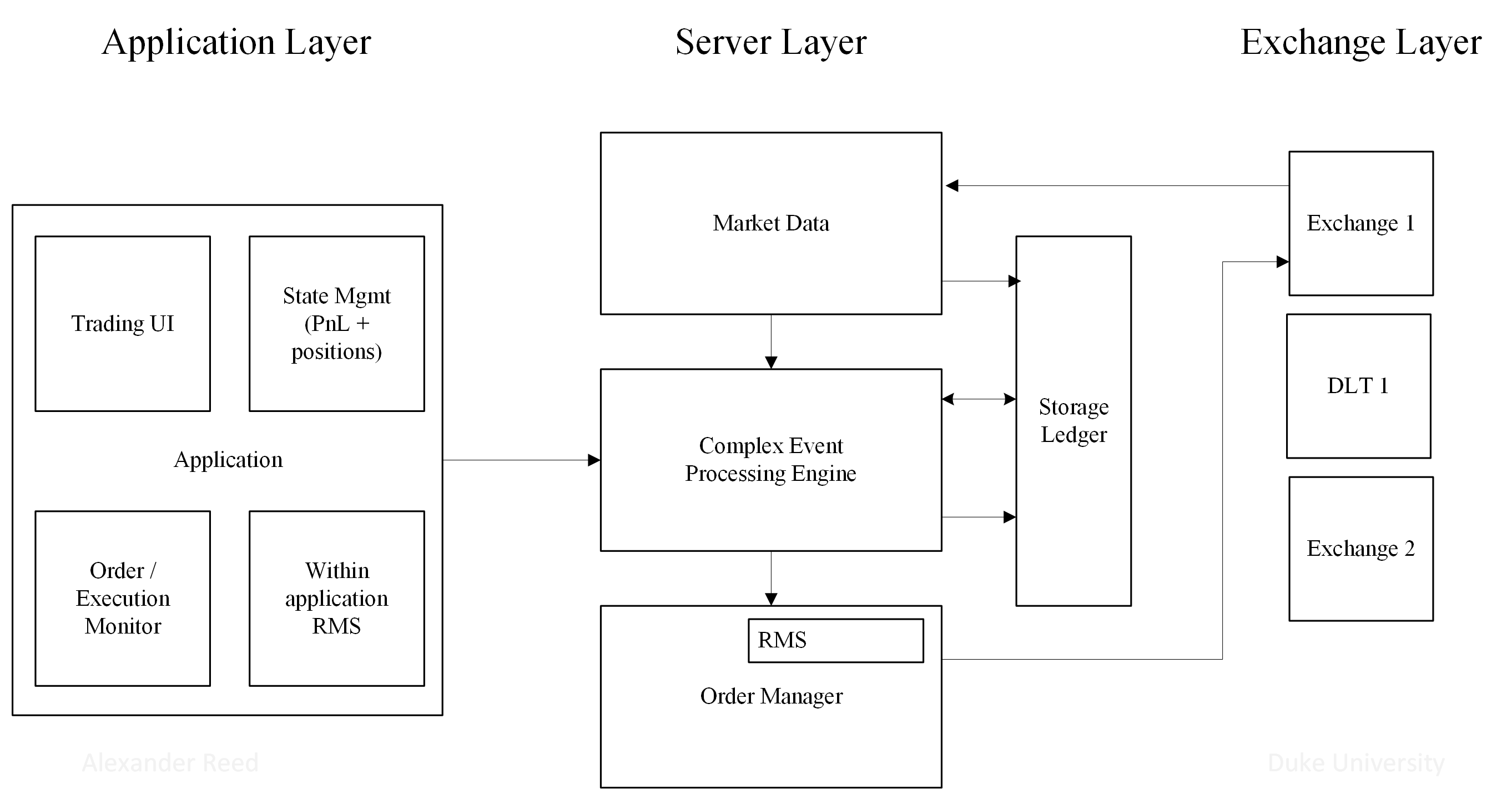

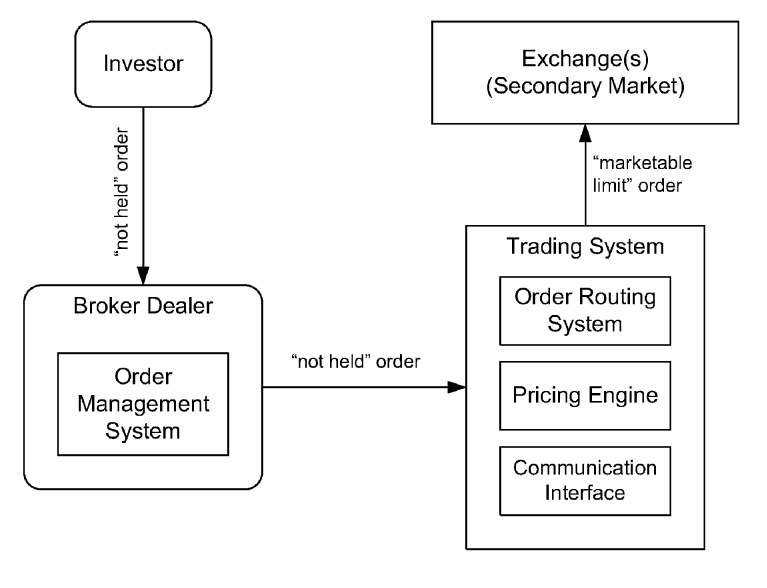

- White-label trading system

- XFT Markets

- Real Estate

- Treasuries

- Luxury Watches

- Predictions

- Insurance

- Music Royalties

- Intellectual Property

- Real Assets

- Tokenized Funds

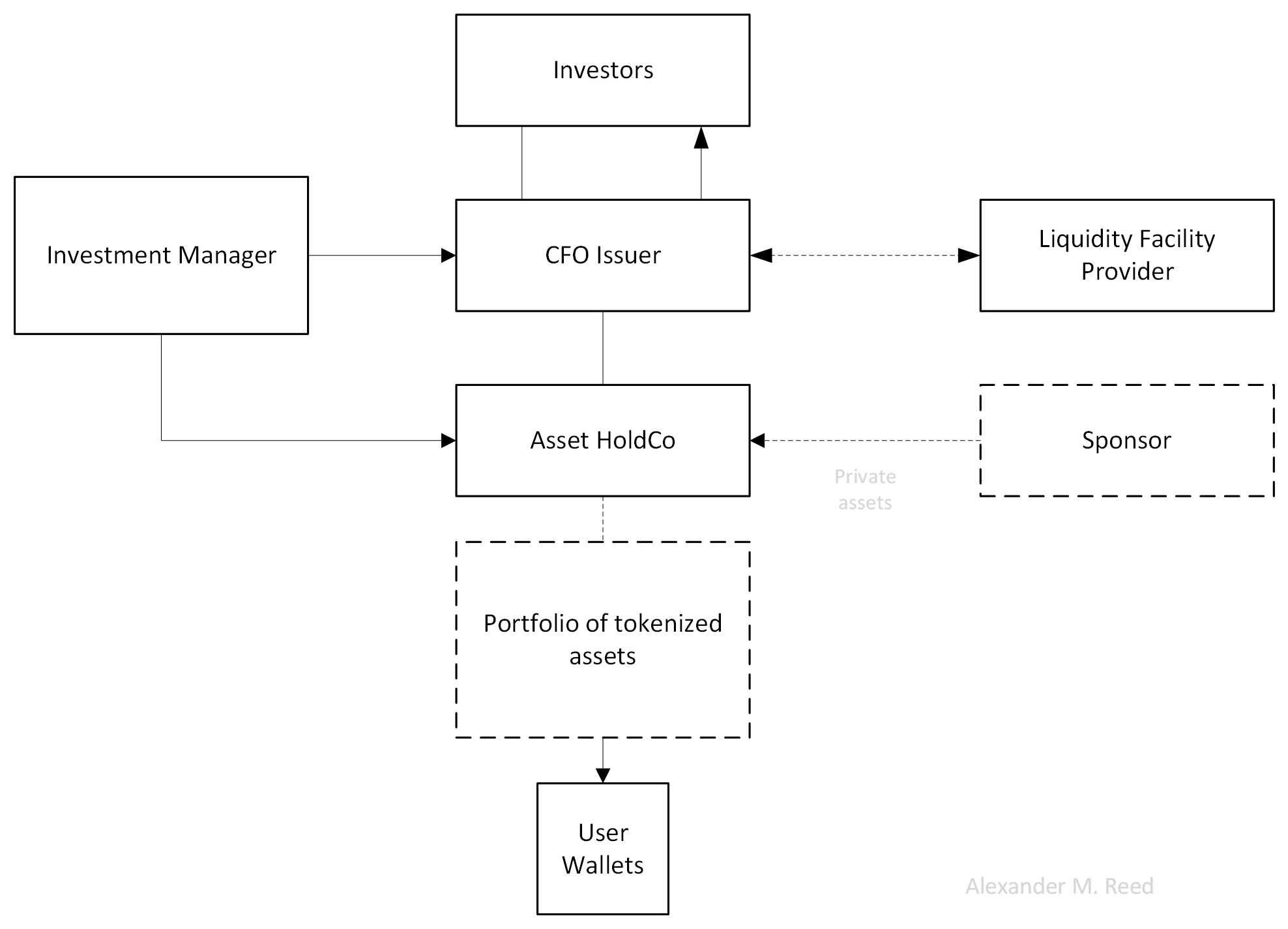

- Structured Products

- ETPs

- Closed-End Funds

- BDCs

- Crypto Index Fund

- Asset-Backed Securities

- Asset-Backed Tokens

- Convertible Bonds

- Smart Derivatives

- CFDs

- Interest Rate Swaps

- Credit Default Swaps

- Equities

- Fixed Income

- Commodities

- Derivatives

- Currencies

- Alternatives

- Marketplace

- Daml

- Data Services

- Money middleware

- Database implementation services

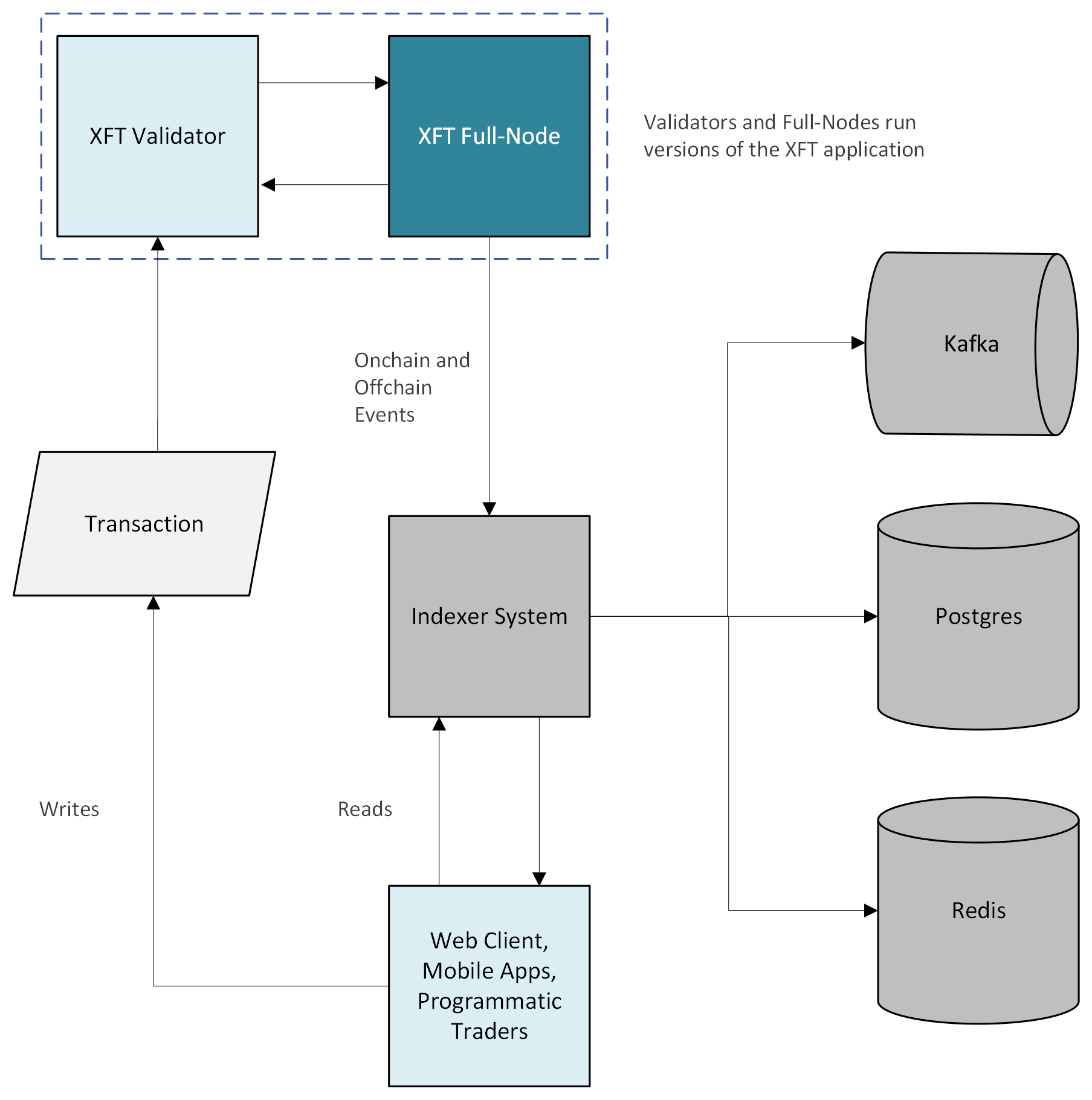

Technical Architecture

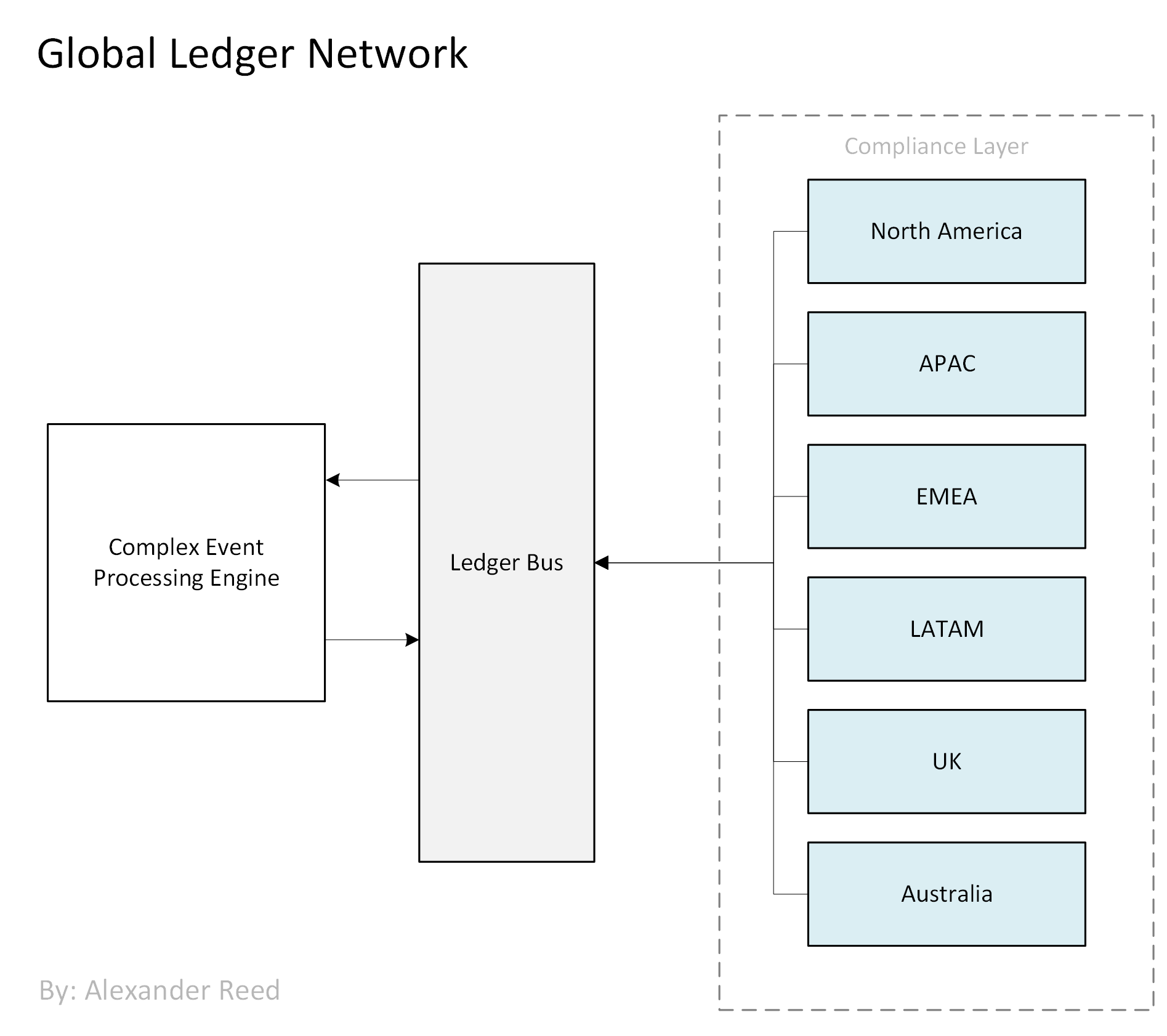

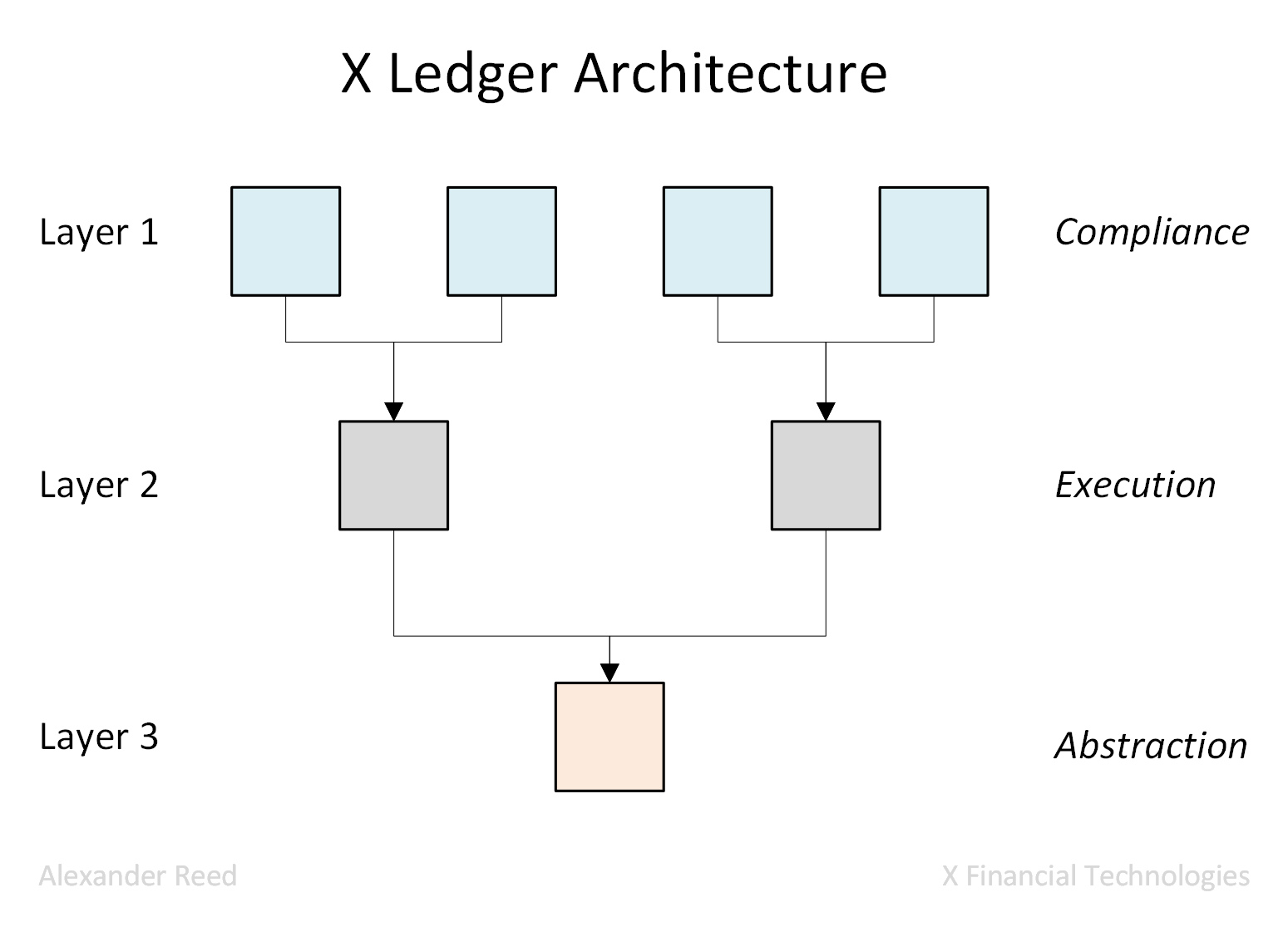

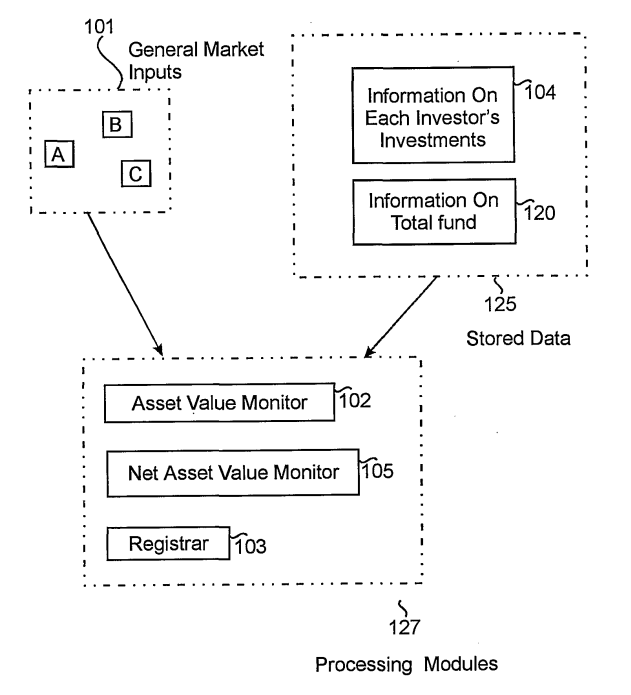

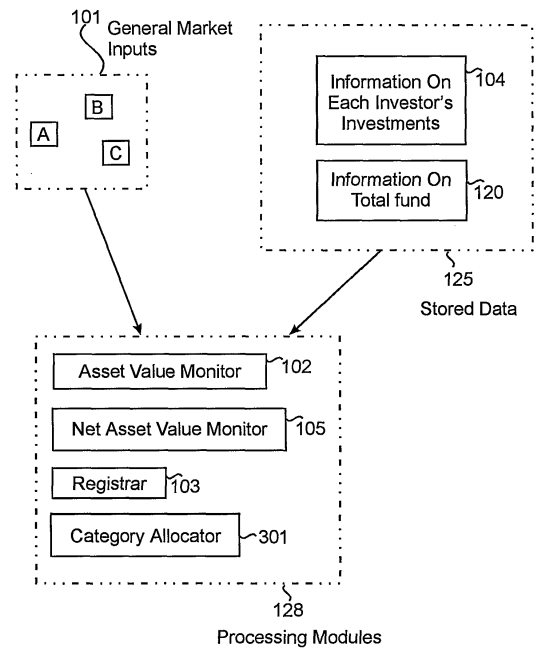

At XFT, we innovate at the intersection of compliance and performance. Our unique multi-layer blockchain structure ensures that we not only meet but update regulatory standards in real-time while providing a seamless, efficient transaction environment.

- Layer 1 - Compliance: Ensures real-time adherence to jurisdiction-specific laws through a regulatory oracle.

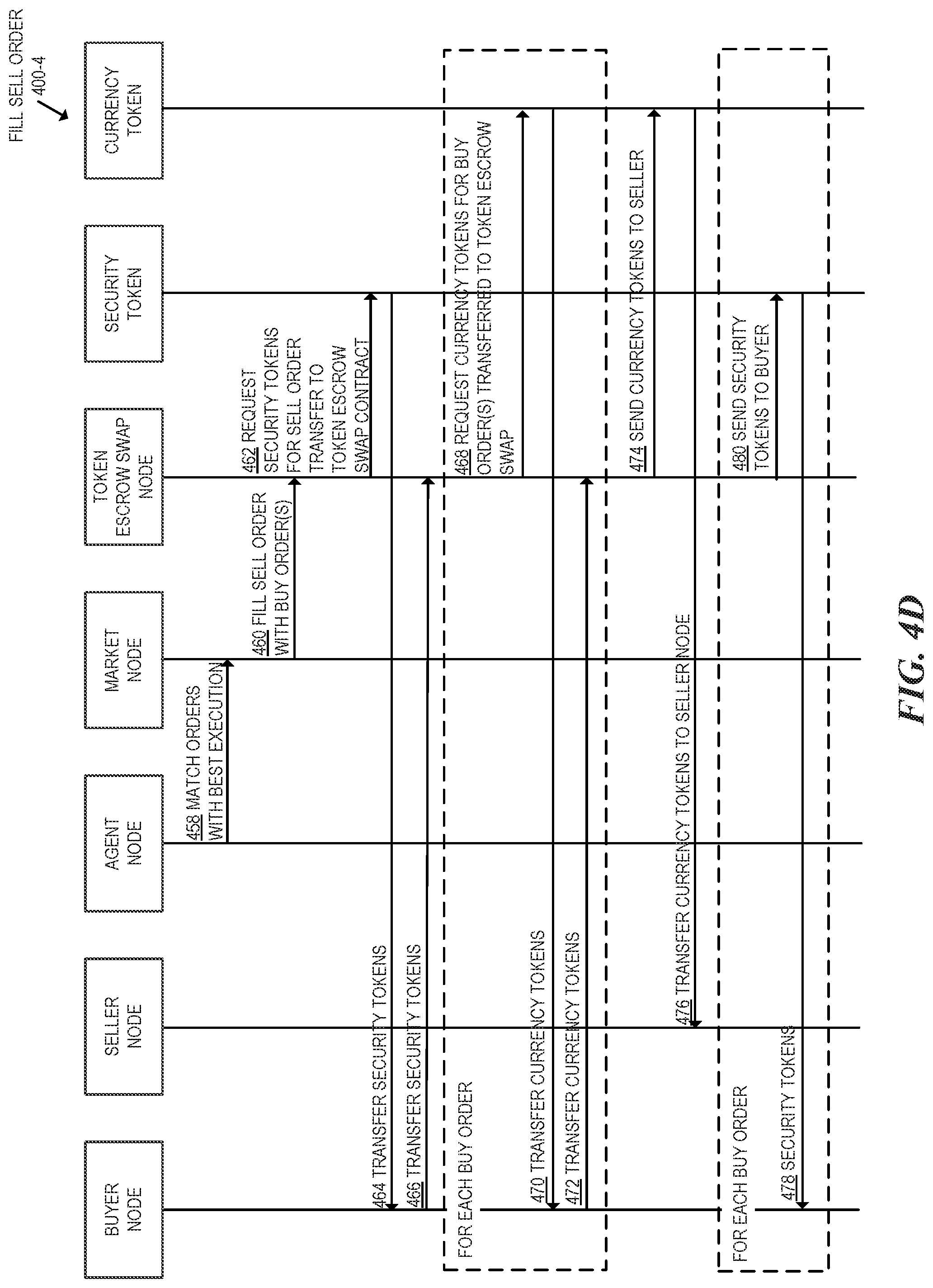

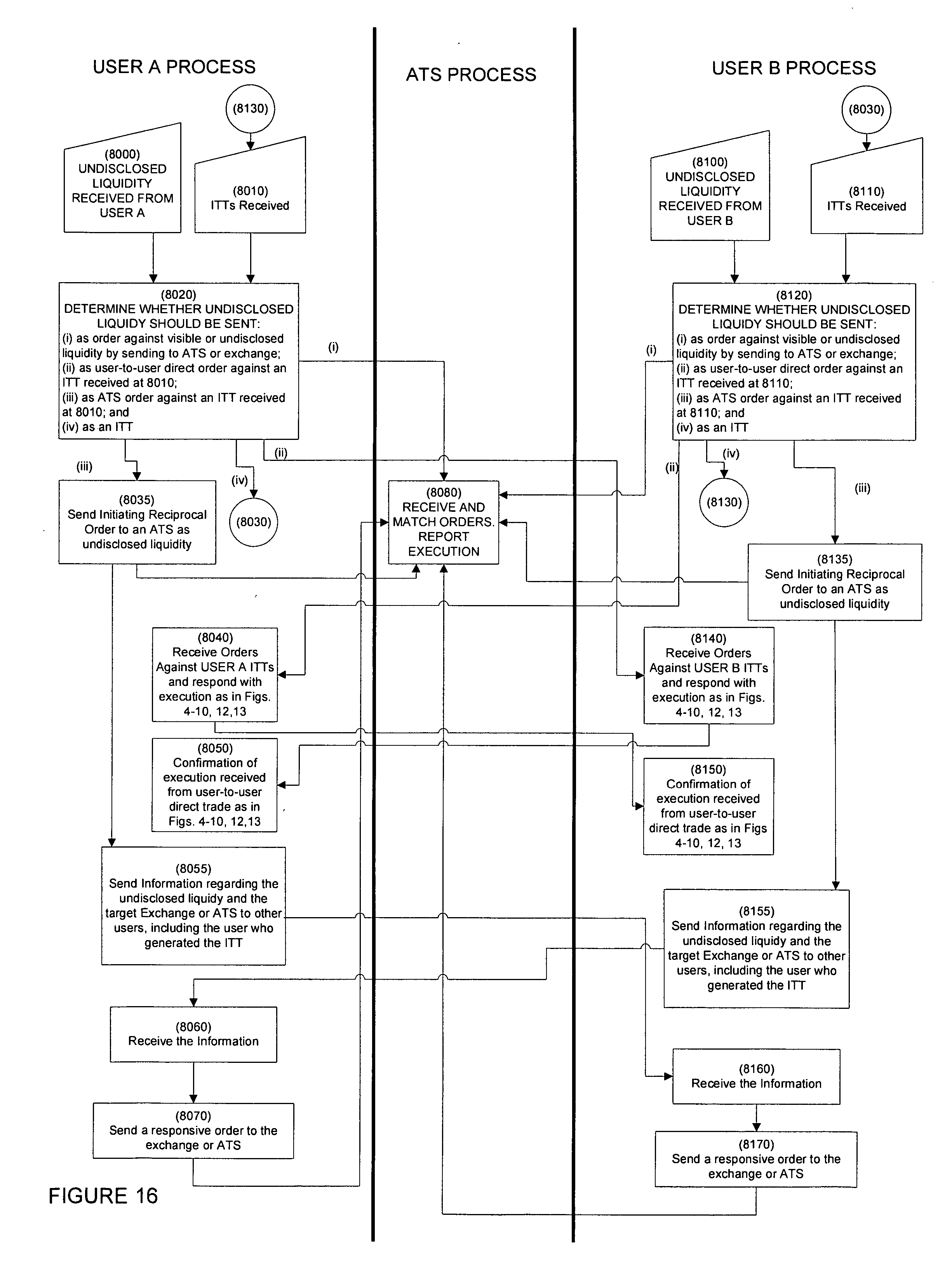

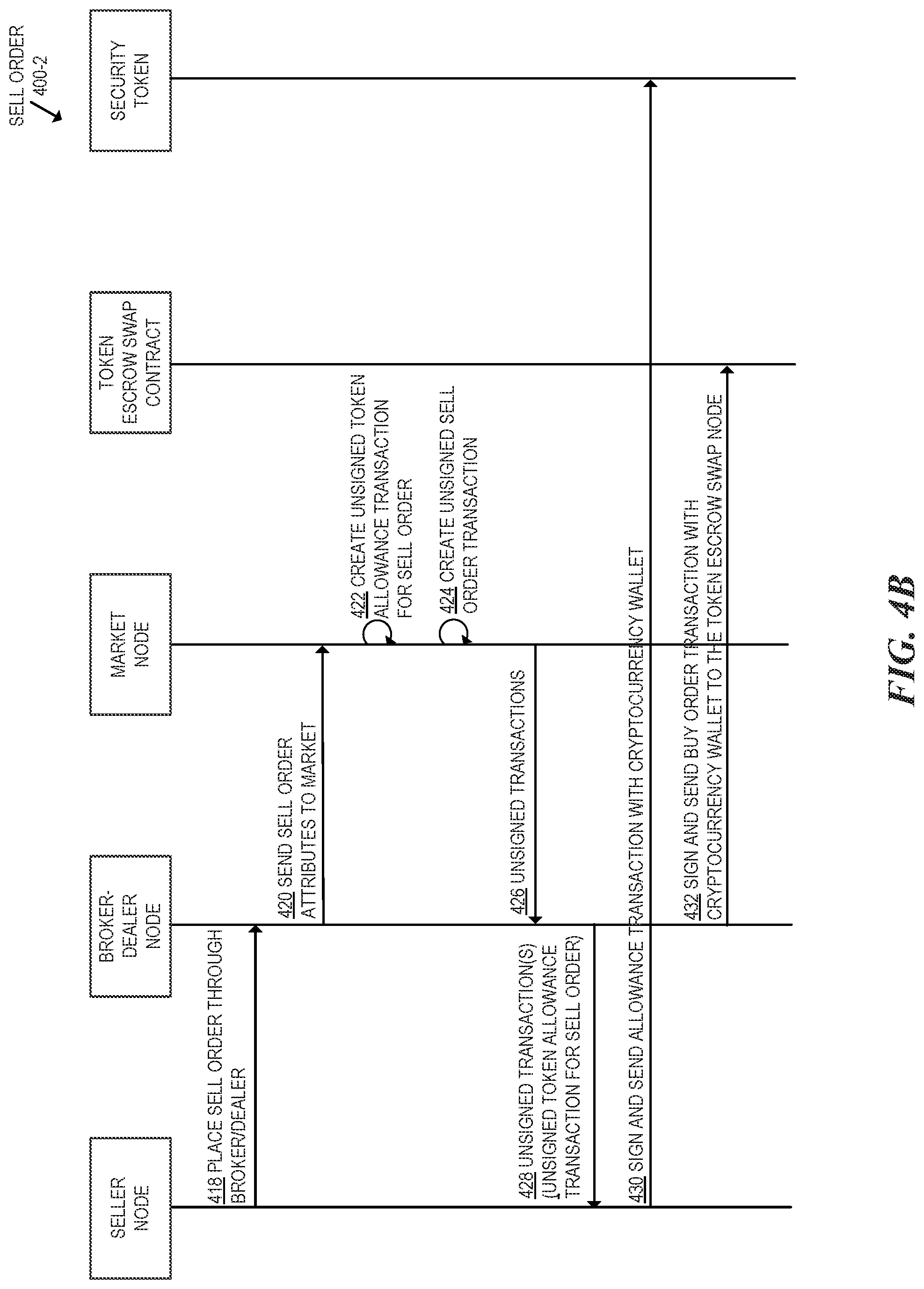

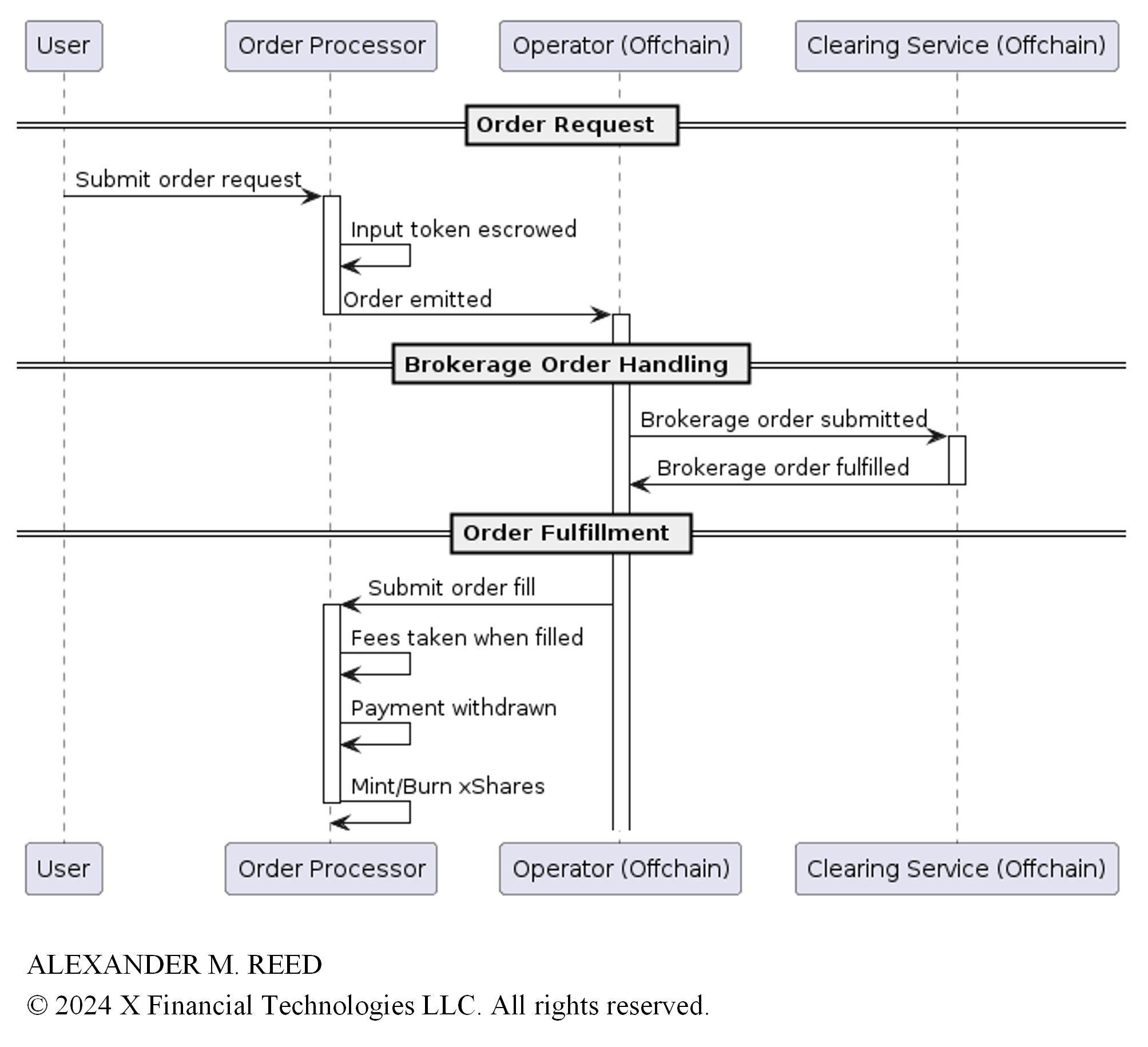

- Layer 2 - Execution: Enables high-performance transaction processing decoupled from compliance checks.

- Layer 3 - Abstraction: Provides a seamless API for continuous UX enhancements without impacting core functionalities.

This architecture enables a range of services from tokenization to real-time asset management while maintaining rigorous compliance and operational excellence.

Resources